The Ultimate Guide to Managing Your Business's Cash Flow

business cash flow

UPDATED ON 2024

10 MIN READ

What is Cash Flow

Cash flow refers to the movement of money in and out of a business. Essentially, it is the amount of cash that a business has on hand to operate, pay its bills, and invest in growth. Cash flow is tracked on a cash flow statement, which shows the cash inflow and cash outflow (or, the money coming into and going out of a business) over a specific period

The Difference Between Cash Flow and Profit

Cash flow and profit are two completely different concepts in business, although they are sometimes mistaken for the same thing. Profit is the amount of money a business makes after deducting all of its expenses from its revenue. Cash flow, on the other hand, is the actual money a business has, on hand, to use at a given point in time.

Understanding the difference between cash flow and net profit, is essential because a business can make relatively high profits yet still experience significant cash flow problems. For example, if a business has high accounts receivable or inventory, it may not have enough cash on hand to pay its bills when they are due, even though it is technically profitable.

Positive Cash Flow

Positive cash flow means that a business has more money coming in than going out. This can be achieved through increased sales, reduced expenses, or a combination of both. With a positive cash flow, a business will be able to pay its bills, invest in new opportunities, and grow. It also provides a cushion for unexpected expenses or downturns in the market.

Importance of Positive Cash Flow

Having a positive cash flow is critical for a business's survival and growth.

It can lead to missed opportunities, increased debt, and even bankruptcy.

Positive cash flow allows a business to have financial stability, reduce its debt, and reinvest in the company. It also enables the business to stay afloat during economic downturns or unexpected costs. Therefore, businesses must manage their cash flow effectively and strive for positive cash flow to ensure long-term success.

Negative Cash Flow

Negative cash flows happen when a business spends more money than it generates. This means that the business has more cash going out than coming in. Negative cash flows can be caused by various factors such as slow-paying customers, high expenses, or investing too much money in inventory or equipment.

Importance of Addressing Negative Cash Flow

Addressing negative cash flow is crucial for a business to stay in operation. Negative cash flow can lead to missed payments, late fees, and even bankruptcy. It can also damage a business's credit score and reputation, making it harder to secure loans or attract investors.

By addressing its negative cash flow, a business can take control of its finances, identify areas of inefficiency or overspending, and implement measures to reduce expenses or increase revenue. This may include renegotiating contracts, reducing inventory, or collecting outstanding debts.

It's essential to address negative cash flow as quickly as possible to avoid the risk of insolvency. By taking action early, a business can improve its financial position and prevent further damage to its operations and reputation. This may even involve seeking professional advice from financial experts or restructuring the business to improve its cash flow management.

Types of Cash Flow

Cash flow refers to the movement of how money flows in and out of a business or organization. Three main types of cash flow are essential for understanding a company's financial health.

Operating Cash Flow

Operating cash flow refers to the cash generated or used in the day-to-day operations of a business, such as from sales revenue, payments to suppliers, payroll expenses, and other operating assets. Operating cash flow is an important measure of a company's ability to generate cash from its core business activities.

Investment Cash Flow

Investment cash flow refers to the cash used for long-term investments. This can include the purchase or sale of property, plant, and equipment, as well as investments in other companies. It is a great way to better understand a company's capital expenditures and its ability to grow its business.

Financing Cash Flow

Financing cash flow is the cash used for financing activities, such as taking out loans or issuing and repurchasing stock. This type of cash flow lets companies have a better understanding of their balance sheet and ability to meet financial obligations and manage capital structure.

Calculating Cash Flow

Cash flow forecasting and budgeting are essential tools for businesses to manage their cash flow effectively. There are a number of important aspects to keep in mind when forecasting and budgeting a business's cash flow effectively.

Cash Flow Forecasting and Budgeting

The process of cash flow forecasting involves estimating future cash inflows from sales, investments, and other sources while estimating future cash outflows for expenses, investments, and other obligations. The net cash flow is then calculated by subtracting the total cash outflows from the total cash inflows.

The analysis of cash flow forecasting allows businesses to calculate cash flow, identify potential issues such as cash shortfalls or surpluses, and take steps to address them. Additionally, creating a cash flow budget outlines expected cash inflows and outflows over a given period, typically a year. The budget should include contingencies for unexpected expenses or revenue shortfalls.

Businesses must regularly monitor actual cash flow and compare actual cash inflows and outflows to the forecasted amounts. This monitoring allows businesses to adjust their budget as necessary and to stay on top of their cash flow. Effective cash flow analysis, forecasting and budgeting can help businesses manage their cash flow, reduce the risk of cash shortages, and make informed financial decisions.

Warning Signs of Cash Flow Problems

Cash flow problems can cause significant challenges for businesses, so it's crucial to identify warning signs early and take corrective action. Late payments to suppliers or vendors can indicate that the business is struggling to manage its cash flow, while overdrafts or bounced checks can be a sign that the business is having difficulty meeting its financial obligations. A steady increase in debt levels can also suggest that the business is relying too heavily on debt to fund operations, and a steady decrease in cash reserves can indicate that the business is not generating enough cash from operations to cover expenses. Declining profits can be a sign that the business is facing declining sales or increasing costs, both of which can negatively impact cash flow.

If the business is consistently unable to pay bills on time, it may indicate that cash flow problems are impacting its ability to meet financial obligations. Additionally, delayed payroll or vendor payments can indicate that the business is having difficulty managing its cash flow. By monitoring these warning signs of cash flow problems, businesses can take appropriate action to address them. This may include implementing more efficient cash flow management strategies, cutting expenses, or seeking additional financing.

Common Causes of Cash Flow Problems

As discussed above, cash flow problems can have serious consequences for businesses, including missed payments, financial instability, and even bankruptcy. Here are some common causes that businesses experience cash flow problems that companies should be aware of:

- Poor sales: A decline in sales revenue can result in a reduction in cash inflows, leading to cash flow problems.

- Slow-paying customers: If customers take too long to pay their invoices, it can cause cash flow problems for the business.

- Overinvestment in fixed assets: Investing too much in long-term assets such as buildings or equipment can tie up cash and limit the ability of the business to manage short-term cash flow needs.

- Inefficient inventory management: Holding excess inventory can tie up cash, making it harder to meet short-term cash obligations.

- Overreliance on debt:Relying too heavily on debt financing can lead to high-interest payments and debt service costs, which can strain cash flow.

- Poor expense management: Inefficient or excessive spending on expenses such as salaries, rent, or utilities can reduce cash flow and create financial instability.

Strategies for Improving Cash Flow

Maintaining positive cash flow is essential for the long-term financial health of a business. Here are some strategies for improving cash flow.

Building a Cash Reserve to Protect Your Business

Building a cash reserve means setting aside a certain amount of money in a separate account to be used as a buffer against unforeseen events that can negatively impact cash flow. By having a cash reserve, businesses can protect themselves from cash flow problems that can arise from unexpected expenses or a sudden drop in sales.

To get started building a cash reserve, businesses should review their cash flow projections and determine how much cash they need to keep on hand to cover their expenses for a certain period of time. A good rule of thumb is to have at least three to six months of operating expenses set aside in a cash reserve. Businesses can then start building their cash reserve by allocating a portion of their profits towards it each month.

Having a cash reserve not only protects businesses from unforeseen events but also gives them the flexibility to take advantage of opportunities that require cash upfront. It can also improve the business's creditworthiness and reduce its reliance on external financing sources.

Utilizing Technology and Tools for Cash Flow Management

There are various types of software and digital tools that can help businesses track, monitor and manage cash flow in real time. Technology can help businesses automate financial processes, streamline operations, and gain insights into their cash flow to make informed financial decisions.

Some of the common tools include:

- Accounting software: Software like QuickBooks, Xero, and FreshBooks help businesses track income and expenses, generate invoices, and manage payments.

- Payment processors: Processors like PayPal, Stripe, and Square make it easy for businesses to accept electronic payments and manage transactions.

- Cash flow forecasting software: Software like Float, Pulse, and Dryrun allow businesses to forecast their cash flow based on historical data and projections, helping them plan and make informed financial decisions.

- Expense management tools: Tools like Expensify and Receipt Bank automate the process of tracking and managing expenses, making it easy to stay on top of business spending.

- Automated payment systems: Payment systems like Bill.com, Zoho Invoice, and Wave Payments help businesses automate payment processes and manage cash inflows and outflows more efficiently.

Creating a Cash Flow Management Plan

It's a good idea for businesses to develop a strategy to effectively manage their cash flow in order to maintain financial stability. A cash flow management plan typically includes several key components, such as cash flow projections, accounts receivable and payable management, inventory management, expense management, and a cash reserve strategy.

To create a cash flow management plan, businesses should first review their current cash flow situation, including their current cash inflows and outflows, and identify areas that need improvement. By developing a cash flow forecast, they can project future cash flows and identify potential cash balance issues. With a clear understanding of their future cash flow situation, businesses can then develop strategies for managing their cash flow, such as managing accounts receivable to ensure timely payment from customers, managing accounts payable to ensure payments are made on time, and optimizing inventory to reduce waste and avoid stockouts.

Getting started with creating a cash flow management plan means taking a proactive approach to financial management and understanding the importance of cash flow for business success. By prioritizing cash flow management and utilizing the right strategies and tools, businesses can optimize their financial health and position themselves for long-term success.

Payroll and Cash Flow

Payroll is an important part of a business's cash flow management. It represents a large expense and can have a major impact on a company's cash flow. Mismanaging payroll can lead to significant cash flow problems and threaten a business's financial stability.

One way that payroll can affect cash flow is by creating a timing mismatch between cash inflows and outflows. For example, if a business pays its employees on a weekly basis but receives payments from customers on a monthly basis, there may be a cash flow gap that needs to be bridged. This can be particularly challenging for businesses with seasonal or cyclical revenue patterns.

To manage payroll and cash flow effectively, businesses can take several steps. One approach is to implement a cash flow forecasting system that incorporates payroll expenses. This can help businesses anticipate when they will need to have cash available to cover payroll costs and avoid any shortfalls.

Another strategy is to implement a cash reserve strategy, which was discussed earlier in this article. By building up a cash reserve, businesses can ensure that they have sufficient cash available to cover unexpected events, including payroll-related issues.

Businesses can also consider implementing payroll software and tools that can help streamline the payroll process, reduce errors, and improve accuracy. Additionally, businesses should consider negotiating payment terms with suppliers and customers to ensure that they have sufficient cash available to cover their payroll expenses.

Cash Flow and Business Credit

How Business Credit Affects Cash Flow

Business credit can have a significant impact on a company's cash flow. Good business credit can provide access to funding and improve a company's financial position, while poor business credit can limit access to funding and increase borrowing costs.

Having good business credit can help businesses secure loans and lines of credit with favorable terms, which can provide a source of cash to cover expenses and investments. This can be particularly important for businesses that are experiencing cash flow gaps or need to make significant investments to grow.

On the other hand, poor business credit can limit a company's ability to secure funding or increase borrowing costs, which can have a negative impact on cash flow. This can make it more difficult for businesses to manage their expenses and investments and can lead to cash flow problems.

Improving Cash Flow Through Better Business Credit

By taking steps to improve their business credit, businesses can access funding and improve their financial position, which can have a positive impact on their cash flow. One way to improve business credit is to establish a positive payment history. This can be achieved by paying bills on time, avoiding late payments, and keeping outstanding debts low. Businesses can also consider working with suppliers and lenders that report payment activity to credit bureaus, as this can help establish a positive credit history.

Another strategy is to reduce outstanding debt. High levels of debt can negatively impact a business's credit score and make it more difficult to access funding. By reducing debt levels, businesses can improve their credit score and increase their chances of securing favorable financing terms.

Businesses can also consider working with a financial advisor or credit specialist to develop a comprehensive credit management strategy. This can help businesses identify areas for improvement and develop a plan to optimize their credit position over time.

Cash Flow and Economic Uncertainty

Not surprisingly, economic uncertainty can have a negative impact on a company's cash flow. During periods of economic uncertainty, businesses may experience lower sales, increased expenses, and reduced access to funding. This can lead to big problems in cash flow and make it more difficult for businesses to maintain their financial position.

Managing Cash Flow During Economic Downturns

To manage cash flow effectively during periods of economic uncertainty, businesses can take several steps. One approach is to review their cash flow projections regularly and adjust them based on changes in the business environment. This can help businesses identify potential cash flow gaps and take steps to address them before they become a problem.

Another strategy is to conserve cash by reducing expenses and delaying non-essential investments. This can help businesses maintain a positive cash flow position and reduce their dependence on external funding sources.

Businesses can also consider alternative funding sources, such as government grants, crowdfunding, and invoice factoring, to supplement traditional funding sources. This can help businesses access funding even during periods of economic uncertainty and reduce their reliance on traditional funding sources that may be more difficult to access.

Finally, businesses can work with financial advisors or business coaches to develop contingency plans and explore new revenue streams. This can help businesses adapt to changing market conditions and mitigate the impact of economic uncertainty on their cash flow.

The Importance of Cash Flow Statements

What is a Cash Flow Statement and Why is it Important?

A cash flow statement is a financial statement that shows how cash is flowing in and out of a business over a specific period of time, typically monthly or quarterly. It presents a summary of a business's cash inflows and outflows, providing a clear picture of the company's liquidity and cash position. The statement of cash flows often breaks down cash flows into three categories: operating activities, investing activities, and financing activities.

The cash flow statement is an essential tool for businesses, as it provides insights into the company's cash flow and liquidity position. It helps businesses understand how much cash is available to pay for expenses, debt payments, and other obligations. Additionally, the statement can help businesses identify potential cash flow problems and take proactive steps to address them.

Investors and lenders also rely on cash flow statements to evaluate a business's financial health and investment potential. By examining a company's cash flow statement, investors and lenders can assess a business's ability to generate cash and pay its debts.

Preparing a cash flow statement involves several steps, including:

- Gathering financial data: Collect financial data from various sources, including bank statements, invoices, and receipts. This data should cover a specific period, typically a month or a quarter.

- Categorizing cash flows: Categorize cash flows into three categories: operating activities, investing activities, and financing activities. Operating activities include cash flows from the day-to-day operations of the business, such as sales and expenses. Investing activities include cash flows from the purchase and sale of assets, such as property and equipment. Financing activities include cash flows from the issuance and repayment of debt and equity.

- Calculating net cash flow: Calculate the net cash flow for each category by subtracting cash outflows from cash inflows.

- Creating the statement: Create the cash flow statement by presenting the net cash flow for each category in a clear and concise format. The statement should also include a summary of the beginning and ending cash balances for the period.

It's important to note that preparing a cash flow statement can be complex and time-consuming. As a result, many businesses rely on accounting software or hire accounting professionals to prepare their cash flow statements.

Revenued's Solutions for Managing Cash Flow

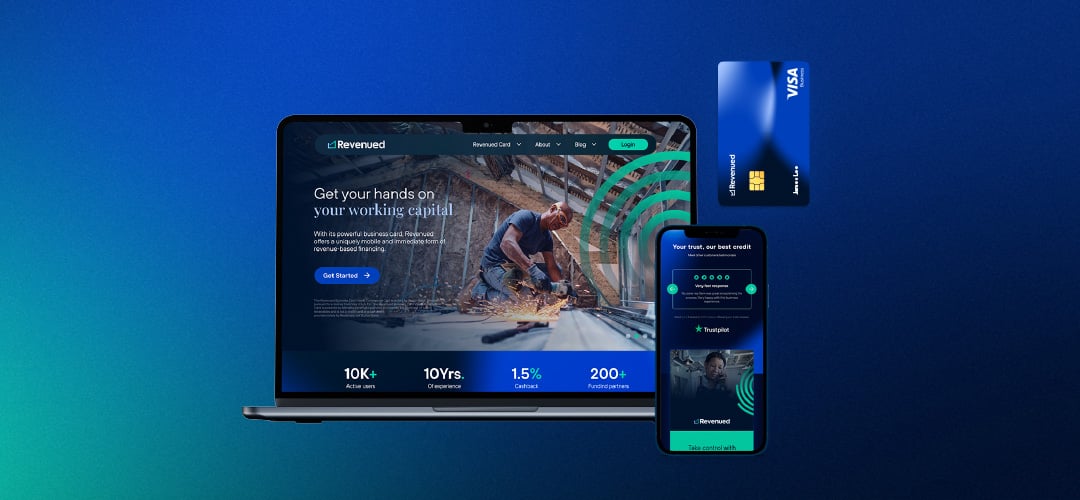

Introduction to the Revenued Business Card

Revenued's Business Credit Card is a game-changer for businesses with limited credit histories or fair credit scores. By basing their approval decision on a company's revenue and cash flow instead of its credit score, they're making it easier for small business owners to access financing.

How the Revenued Business Card Can Help Manage Cash Flow

Cash flow is a crucial factor in any business's success, and Revenued's Business Credit Card can help business owners manage their cash flow more efficiently. With a spending limit that increases as a company's revenue grows, businesses can use this card to cover unexpected expenses or manage their day-to-day operations.

Plus, with no APR and no hard credit inquiry required, business owners can keep their personal credit scores safe while accessing financing. This card is a powerful tool for any business owner looking to manage their finances better.

Introduction to the Revenued Flex Line

Revenued's Business Loans offer quick funding solutions to help businesses get the funds they need - fast. With the ability to get up to $500K in as little as 24 hours, thousands of business owners have benefited from their funding solutions.

Whether businesses need to purchase inventory, cover payroll, or expand operations, Revenued's Business Loans can provide the financing they need. Unlike traditional lenders who base their decision on credit scores and collateral, Revenued's loans are based on a company's revenue and cash flow, making it easier for businesses with limited credit histories to access funding.

Read More About Business Cash Flow

FAQs About Business Cash Flow

Cash flow refers to the movement of money in and out of a business over a specific period. It represents the inflow and outflow of cash from various activities, including sales, expenses, investments, and financing. Positive cash flow means the business is generating more cash inflows than outflows, indicating a healthy financial position. Conversely, negative cash flow implies that the business is spending more than it is earning, which can lead to financial difficulties if sustained over time.

The three types of cash flows are operating cash flow, investing cash flow, and financing cash flow. Operating cash flow refers to the cash generated or used in day-to-day business activities, such as revenue from sales and payment of expenses. Investing cash flow represents the cash flow resulting from buying or selling long-term assets, such as equipment or investments. Financing cash flow includes the cash flows associated with raising capital or repaying debts, such as obtaining a loan or issuing stock.

Positive cash flow does not necessarily mean profit or income. Cash flow represents the movement of cash in and out of a business, whereas profit or income is the surplus obtained when revenue exceeds expenses. Positive cash flow indicates that the business has more cash inflows than outflows, providing a healthy liquidity position.

However, it's possible for a business to have positive cash flow while experiencing a net loss. This can occur if the business receives cash from previous sales or financing activities, even if the current period's expenses exceed revenue. Profitability and cash flow are distinct financial indicators, and both should be carefully analyzed to assess the overall financial health of a business.

Several early warning indicators can signal cash flow problems within a business. These include frequent delays in customer payments, declining sales or revenues, increasing accounts payable or overdue invoices, excessive inventory levels, and high levels of debt or loan defaults. Additionally, consistent negative cash flow or difficulty in meeting financial obligations can also indicate cash flow issues.

Monitoring these indicators and addressing them promptly can help businesses take proactive measures to improve their cash flow, such as implementing effective credit and collection policies, controlling expenses, and exploring financing or cost-cutting strategies.

Cash flow problems are a common challenge for businesses, but there are several strategies to avoid them. Some common cash flow problems include late payments from customers, unexpected expenses, excessive inventory, and over-investment in fixed assets. To avoid these problems, businesses can implement strategies such as:

-

- Establishing clear payment terms and following up on overdue payments.

- Creating a cash reserve to prepare for unexpected expenses.

- Managing inventory levels to avoid excess stock.

- Investing in assets that generate cash, such as equipment or property that can be rented out.

By implementing these strategies, businesses can prevent cash flow problems and ensure they have enough cash on hand to meet their financial obligations.

Improving cash flow is essential for the success of any business. Some strategies for improving business cash flow include:

- Reducing expenses: Reviewing expenses and finding ways to cut costs can free up cash flow.

- Increasing sales: Expanding your customer base and increasing sales revenue can boost cash flow.

- Negotiating better payment terms: Negotiating with suppliers and customers to extend payment terms can help manage cash flow

- Managing inventory: Maintaining optimal inventory levels can prevent overstocking and improve cash flow.

Business credit can be an effective tool for managing cash flow. By establishing a good credit score and securing credit lines, businesses can access funds quickly and easily when needed. This can help manage cash flow during periods of slow sales or unexpected expenses.

Additionally, businesses can use credit to take advantage of opportunities for growth, such as through business acquisitions, expanding product lines or purchasing new equipment. However, it's important to use credit responsibly and to only borrow what can be repaid in a timely manner to avoid accruing excessive debt.

Strong cash flow is characterized by consistent and positive cash inflows from operational activities. It demonstrates that a business has a healthy cash position, allowing it to cover expenses, invest in growth opportunities, and meet financial obligations.

Factors that contribute to strong cash flow include effective cash management, efficient operations, timely collections from customers, and appropriate control of expenses. Additionally, maintaining a sustainable cash flow over time indicates the business's ability to generate ongoing profitability and withstand financial challenges.

Free cash flow is considered more important than profit because it provides a clearer picture of a business's financial health and its ability to generate cash for various purposes. Profitability measures the surplus of revenue over expenses, but it doesn't necessarily reflect the cash available for reinvestment or debt repayment

Free cash flow, on the other hand, considers the cash generated from operations after accounting for capital expenditures required to maintain or expand the business. It indicates the cash available for reinvestment, debt reduction, dividend payments, or other uses. By focusing on free cash flow, businesses can better assess their financial flexibility, evaluate investment opportunities, and make informed decisions regarding capital allocation.

Yes. Free cash flow is commonly used to calculate the Net Present Value (NPV) of an investment. NPV is a financial metric that assesses the profitability of an investment by discounting the future cash flows to their present value.

By using free cash flow as the basis for NPV calculations, businesses and investors can determine whether an investment or project is financially viable. The NPV analysis helps evaluate the potential return on investment and enables comparison with other investment opportunitie

The purpose of the statement of cash flows is to provide a comprehensive overview of a company's cash inflows and outflows during a specific period. It presents information on cash generated or used by operating activities, investing activities, and financing activities.

The statement of cash flows helps stakeholders understand the sources and uses of cash, assess the company's liquidity, and evaluate its ability to meet financial obligations. It complements the income statement and the company's balance sheet by providing insights into the actual cash movement within the business, offering a more accurate picture of its financial performance.