Meet the creators behind Revenued

We’ve teamed up with top influencers helping small businesses thrive all across the United States... Now it’s your turn!

What’s better than helping to build small business success while building your own content? Become a Revenued creator and earn cash for every qualified referral driven by your digital assets.

We’ve teamed up with top influencers helping small businesses thrive all across the United States... Now it’s your turn!

Help business owners unlock their full potential by accessing working capital on demand with Revenued. Sign up today and start creating with Revenued.

Learn more by filling out our content creator form to let us know you’re interested.

We’ll connect you with a member of our partnerships team to bring your vision to life and map out the next steps.

.png)

Start doing what you do best—develop top tier content!

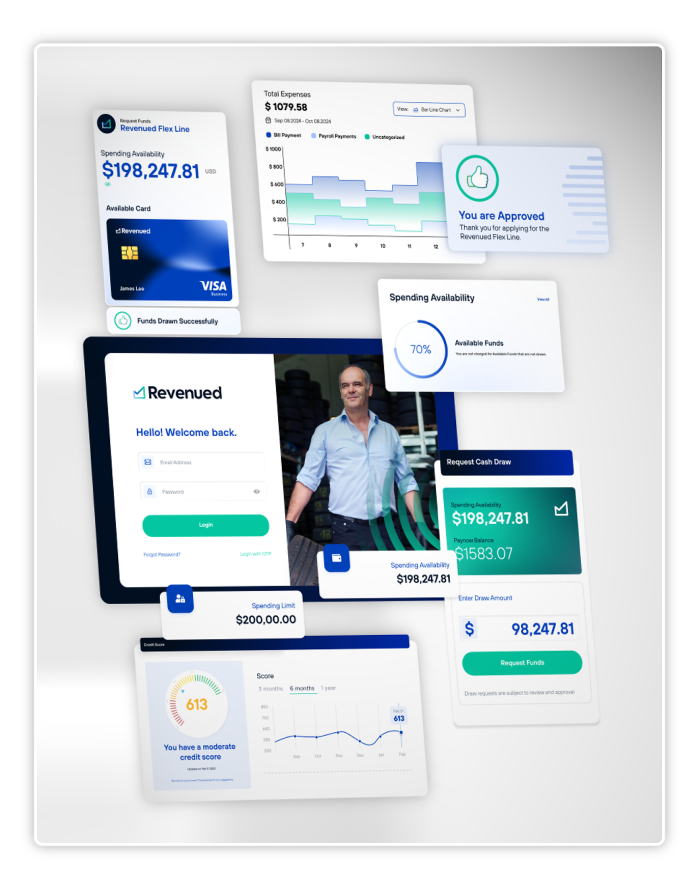

We’re on a mission to bring Revenued’s innovative revenue-based financing solution to as many small businesses as possible. And who better to help us connect than you? As an influencer, making those connections is your expertise. We’d love to team up and see how we can reach even more businesses together. By helping your audience discover a solution like Revenued, we’re able to increase our reach and ensure no small business is turned down for funding because of something like a low personal credit score.

Join our influencer program and earn commissions for each successful referral made through your unique link. The specifics will vary for each creator, and we’ll go over the details later. You handle the influencing, and we’ll manage the sales, service, and funding.

Revenued leverages advanced online technology and underwriting to provide flexible terms and the fastest response times in the industry for small business owners.

Businesses with even subprime credit can see approvals of up to $500,000 with 24/7 access to funds via their Revenued Business Card or online Revenued Flex Line.

Minimum eligibility requirements from small businesses include:

![]() Being in business in the US at least 1 year

Being in business in the US at least 1 year![]() Maintaining a separate business bank

Maintaining a separate business bank![]() At least $20k in monthly deposits

At least $20k in monthly deposits ![]() Being any entity other than a Sole Proprietorship

Being any entity other than a Sole Proprietorship![]() And other criteria

And other criteria

Meet other customers testimonials